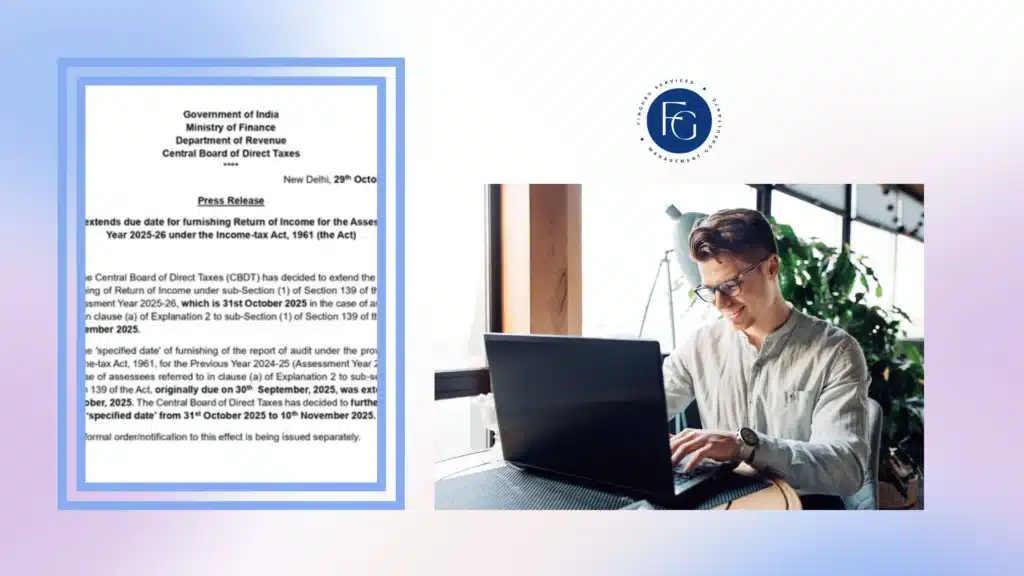

The Central Board of Direct Taxes (CBDT) has given taxpayers some much-needed relief this year. The due dates for filing the Income Tax Return (ITR) and the Tax Audit Report for the Assessment Year 2025–26 have been extended under the Income-tax Act, 1961.

The Central Board of Direct Taxes (CBDT) has given taxpayers some much-needed relief this year. The due dates for filing the Income Tax Return (ITR) and the Tax Audit Report for the Assessment Year 2025–26 have been extended under the Income-tax Act, 1961.

FinGuru Services India Private Limited offers a 360° solution for all your corporate services.

A- 2106, Privilon, Iskcon Cross Roads, Ambli Rd, Ahmedabad, Gujarat 380015

Finguru India is a private consultancy firm providing professional assistance for company registration. We are not a government website and are not affiliated with the Ministry of Corporate Affairs (MCA). Government fees are charged separately as per applicable laws.

The Central Board of Direct Taxes (CBDT) has given taxpayers some much-needed relief this year. The due dates for filing the Income Tax Return (ITR) and the Tax Audit Report for the Assessment Year 2025–26 have been extended under the Income-tax Act, 1961.