Introduction

Every successful business begins with a good idea, but turning that idea into a thriving company requires careful planning, and one of the first major decisions you’ll face is:

Which type of business structure is right for you?

It’s not just about forms and registrations — your choice of business model will directly affect how your business operates, how it’s taxed, how much personal risk you’ll take on, and how others perceive your brand.

Many entrepreneurs dive straight into selling their product or service without paying attention to this, only to realise later that the wrong structure can hold them back, whether it’s difficulty raising funds, facing higher taxes, or dealing with unexpected legal liabilities.

That’s why it’s crucial to spend a little time upfront understanding the different options available. Choosing the right business model is like setting the proper foundation before building a house. With the right foundation, your business will be better positioned to grow sustainably, expand operations, attract investors, and stay compliant with Indian laws.

In this blog, we explain:

- The four most popular business structures in India

- Their key features and how they differ

- How to figure out which one fits your goals, resources, and vision

These are the four most popular business structures in India:

- Sole Proprietorship

- Limited Liability Partnership (LLP)

- Private Limited Company (Pvt Ltd)

- One Person Company (OPC)

Let’s explore these in detail to help you decide.

Why Choosing the Right Business Model Matters

Think of your business structure as the foundation of your house. A weak foundation can limit how tall you can build or make it vulnerable during storms (legal trouble, financial risk, etc.). Similarly, choosing the wrong structure may:

- Limit your access to funding

- Expose your assets to risk

- Make compliance complicated when you grow

By understanding your vision, risk appetite, and resources, you can choose a structure that will support your growth, not hinder it.

Overview of Indian Business Entity Options

Here’s a quick table to give you an overview before we dive deeper:

| Entity Type | Best Suited For |

| Sole Proprietorship | Freelancers, very small businesses |

| LLP | Professional services, small partnerships |

| Private Limited | Startups, businesses planning for investment |

| OPC | Solo founders with plans for growth |

Understanding the Four Business Structures

What is a Sole Proprietorship?

A Sole Proprietorship is one of the most basic forms of business ownership, owned by one person without a separate legal identity.

Real-Life Example:

Ramesh runs a small general store in his locality. He registers under GST and files taxes as an individual. His business and personal assets are treated as one.

Perfect for Small shops, freelancers, and individual consultants.

Read our Article:

How to Search a GST Number Using a Company Name

How to Apply for a GST Number Online in India

What is an LLP (Limited Liability Partnership)and LLP meaning?

An LLP combines the flexibility of a partnership with the benefits of limited liability typically found in a private limited company. It provides partners with the benefit of limited liability while maintaining the freedom to manage the business as they see fit.

Real-Life Example:

For example, a group of interior designers may form a limited liability partnership, with each partner contributing their specialised skills.

Perfect for: Law firms, CA firms, small service companies with partners.

What is a Private Limited Company (Pvt Ltd)?

A Private Limited Company is the preferred structure for startups and growing businesses in India. It has a separate legal status, can raise funding, and provides limited liability.

Real-Life Example:

Swati launches a tech product startup. She forms a Private Limited Company and later raises funding from investors.

Perfect for: Startups, technology companies, businesses with high growth ambitions.

What is an OPC (One Person Company)?

An OPC is a unique format that allows a single individual to enjoy the benefits of a corporate structure, including limited liability, while maintaining control.

Real-Life Example:

A content creator with big expansion plans forms an OPC to protect personal assets while building their brand.

Perfect for: Solo entrepreneurs with future growth ambitions.

Read More: Company Registration in India for Foreigners: Which Structure is Best for You?

Difference Between Business Structures According to Key Features

| Feature | Sole Proprietorship | LLP | Pvt Ltd | OPC |

| Legal Identity | No | Yes | Yes | Yes |

| Liability | Unlimited | Limited | Limited | Limited |

| Number of Owners | 1 | 2+ partners | 2-200 | 1 |

| Compliance | Low | Medium | High | Medium-High |

| Taxation | Individual slabs | 30% + cess | 22%-30% | 22%-30% |

| Funding Access | Difficult | Limited | Best | Limited |

Pros and Cons of Each Model

Sole Proprietorship

Pros:

- Minimal paperwork

- Complete ownership and control

- Suitable for very small businesses

Cons:

- Unlimited personal liability

- Cannot issue shares or bring in partners

- Perception may be less professional in formal sectors

LLP (Limited Liability Partnership)

Pros:

- Limits partner liability to their investment

- Suitable for professionals

- No dividend distribution tax

Cons:

- Cannot attract equity investors

- Flat 30% tax irrespective of income

- More formalities compared to proprietorship

Know More: Who Can Start an LLP in India?

Private Limited Company

Pros:

- Eligible for raising venture capital

- Limited liability protection

- Recognized internationally

Cons:

- Mandatory annual filings with ROC

- Directors’ responsibilities and penalties for non-compliance

- Slightly complex closure process

OPC (One Person Company)

Pros:

- Enjoys many Pvt Ltd benefits with single ownership

- Provides legal protection to personal assets

- Helps in establishing credibility for small solo ventures

Cons:

- Cannot have more than one shareholder

- Similar compliance obligations to Pvt Ltd

Know More: How to Start a One-Person Company in India

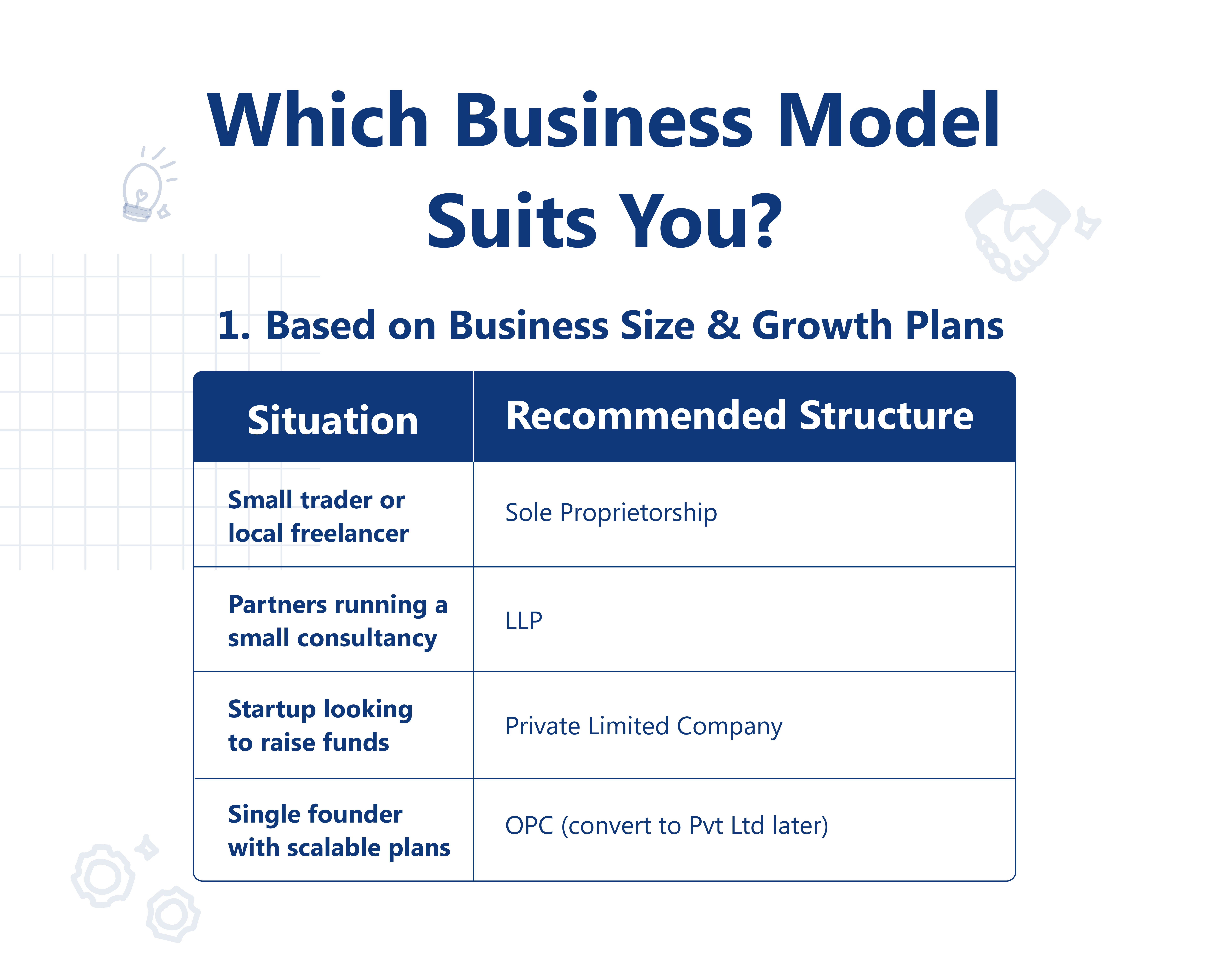

Which Business Model Suits You?

1. Based on Business Size & Growth Plans

2. Based on Liability Preference

- Want personal protection? ➔ LLP / Pvt Ltd / OPC

- Okay with personal risk? ➔ Sole Proprietorship

3. Based on Ownership and Control

- Want full control alone? ➔ Sole Proprietorship / OPC

- Want partners/co-founders? ➔ LLP / Pvt Ltd

4. Based on Compliance Willingness

- Hate paperwork? ➔ Sole Proprietorship

- Willing to meet formalities for protection and scalability? ➔ LLP / Pvt Ltd / OPC

Registration & Compliance Overview

Basic Steps for Registration

| Business Type | Registration Process |

| Sole Proprietorship | GST (if applicable), Udyam Registration, Shop Act |

| LLP | MCA Portal, LLP Agreement, PAN, TAN, GST |

| Private Limited | SPICe+ Form, DIN for directors, PAN, TAN, GST |

| OPC | SPICe+ Form, PAN, TAN, GST |

Ongoing Legal & Tax Compliance

| Type | Compliance Requirements |

| Sole Proprietorship | Income Tax Return (ITR), GST Return (if applicable) |

| LLP | Annual filing of Form 8, Form 11, and ITR |

| Private Limited | Annual returns with ROC, ITR, board meetings, General Meetings, and audits |

| OPC | Similar to Pvt Ltd, with exemption from AGM |

Case Scenarios & Examples

- Freelancer/Consultant (Graphic Designer, IT Professional) ➔ Start as a Sole Proprietor; switch to LLP if working with partners.

- Startup with Product or Tech Platform ➔ Private Limited Company from Day

- Local Retail Shop ➔ Sole Proprietorship or LLP depending on size.

- Solo Entrepreneur (Influencer, Author, Designer) Wanting to Grow Nationally ➔ OPC (later convert to Pvt Ltd)

Conclusion

Summary of Key Differences

| Want This… | Choose This… |

| Easy start, no frills | Sole Proprietorship |

| Partnership, limited risk | LLP |

| VC investment, scalability | Private Limited Company |

| Solo with corporate status | OPC |

Final Tips for Choosing the Right Structure

- Start with your business goals first — are you building a lifestyle business or a startup?

- Think 3-5 years ahead — not just immediate convenience.

- Take professional help — mistakes in setup can cost more later in the restructuring process.

Need help deciding or registering your business? That’s exactly where we come in. We guide entrepreneurs like you in choosing, registering, and successfully managing the right business structure tailored to your goals.

Book a Consultation with Our Expert!

Call Us: +91-9999127022

Visit: www.FinguruIndia.com

FAQs

Q1: Can I convert from Sole Proprietorship to Pvt Ltd later?

Yes. But it involves the transfer of assets and liabilities and can be complex depending on the nature.

Q2: What’s the tax advantage of a Pvt Limited Company?

Private limited companies may enjoy concessional rates under certain schemes, especially for new manufacturing or startup units.

Q3: Why don’t investors prefer LLPs?

Because LLPs can’t issue equity shares, it makes it hard for investors to have ownership stakes.

Q4: Can I form an OPC if I already have another company?

An individual can incorporate only one OPC at a time.

Add a Comment