Are you someone with a business idea but no partners to join you? Want to keep complete control of your business while enjoying the benefits of a registered company? If yes, then a One Person Company (OPC) could be your perfect solution.

A one-person company allows one to run a registered company with limited liability. It’s a great way to start a formal business in India without a partner or co-founder. Many first-time entrepreneurs and solo business owners choose OPC to grow with confidence. A One Person Company (OPC) is a unique business structure introduced in India under the Companies Act 2013. It allows a single entrepreneur to operate as a corporate entity with limited liability and complete control. OPC offers the advantages of a private limited company—like legal recognition, separate identity, and easier access to funding, while keeping the compliance burden low for solo founders.

In this blog, we will explain everything you need to know—from how to open a firm as an OPC to OPC registration, documents, rules, and yearly compliance. Whether you’re a freelancer, a small trader, or a digital business owner, this step-by-step guide will help you start smart.

Let’s begin your journey to setting up a One-person company registration—the right way.

What is a one-person company?

A One Person Company is a business set up by one person. It is a special type of private limited company. The idea was for solo business owners who want to work alone but still want company-level benefits.

It gives you:

- A legal identity (separate from you)

- Control over decisions

- Limited risk (your money is safe)

Who Can Start a One Person Company?

Not everyone can start an OPC. You must:

- Be an Indian citizen

- Be over 18 years old

- Live in India for 120+ days in a year

You must also pick a nominee who will take over the company if something happens to you. This person must also meet the same rules.

Key Features of One Person Company

- One owner: You run the show.

- One nominee: A backup person, not a partner.

- Legal status: It is different from you.

- Limited liability: Your money is not at risk if the business fails.

- Company name ends with OPC: Like “Ravi Soaps (OPC) Private Limited”.

Why Choose a One-Person Company?

- You are a solo founder

- You want to protect your savings

- You want to grow slowly, then expand

- You want your brand name to be safe

Unlike a sole proprietorship, an OPC gives you legal strength. It shows buyers, banks, and vendors that you mean business.

Documents Needed for OPC Registration

For the Owner:

- PAN card

- Aadhaar card

- Passport-size photo

- Email ID & mobile number

- Address proof (electricity bill, bank statement)

For the Nominee:

- PAN and Aadhaar

- Consent letter (Form INC-3)

For Office Address:

- Electricity bill or rent agreement

- NOC from the owner (if rented)

How to Open a Firm: Step-by-Step OPC Registration

Step 1: Get Your Digital Signature Certificate (DSC)

This is like your online signature. You’ll need this to sign forms.

Step 2: Apply for Director Identification Number (DIN)

Every director must have a DIN.

Step 3: Name Approval

Use the SPICe+ Part A form on the MCA portal to apply for a company name. It must be unique and include “(OPC) Private Limited”.

Step 4: Fill out the SPICe+ Part B Form

Add your details, business activity, office address, nominee details, etc.

Step 5: Submit MOA & AOA

These are the rules of your company. You can use templates or create your own.

Step 6: Get a Certificate of Incorporation

Once the MCA approves your form, you will get this certificate. Your OPC is now legally registered!

What to Do After One Person Company Registration?

- Open a current bank account

- Apply for PAN and TAN (if not done already)

- Register under GST (if needed)

- Buy a domain & set up email

- Print company letterhead and seal

- Get a Shop Act license (if required for your location)

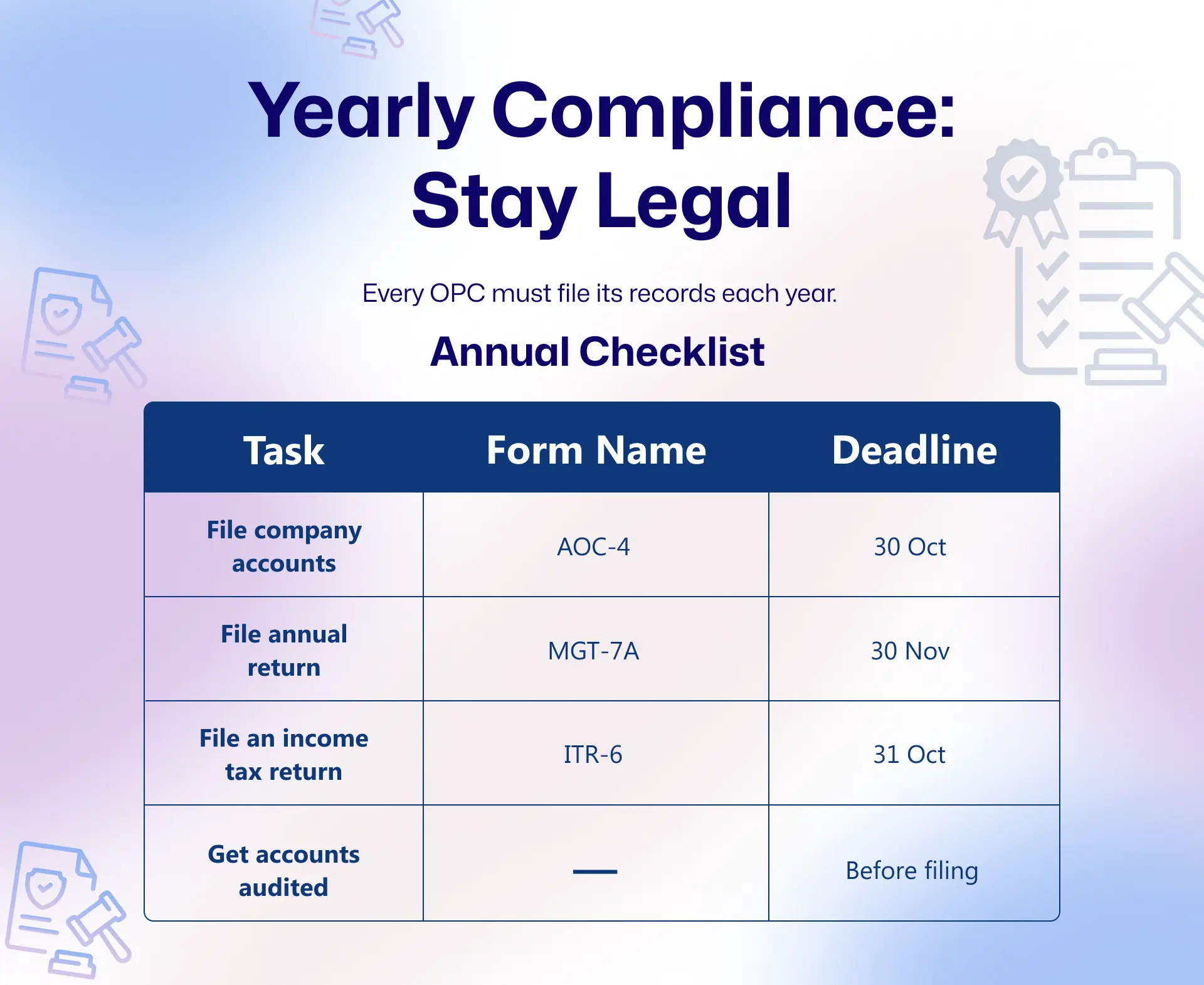

Yearly Compliance: Stay Legal

Tax Rules for One-Person Company

- Tax rate – Flat 25% on profits

- You may also pay MAT (Minimum Alternate Tax) if needed

- No dividend distribution tax

- There is no tax if you take a salary from the OPC (as an employee)

Pro tip: Take both salary and dividends to save tax wisely.

Converting OPC to Private Limited

You must convert your OPC into a Private Limited Company if:

- Turnover goes above ₹2 crore

- Paid-up capital goes above ₹50 lakh

Steps to convert:

- Pass a board resolution

- Inform MCA using Form INC-6

- File a new MOA, AOA

- Get a new certificate

You can also convert voluntarily after 2 years.

Advantages of OPC

Starting a business as a One Person Company (OPC) gives you the best of both worlds—freedom and legal safety. Here’s how:

- One owner: You can start and run the business alone without a partner or co-founder.

- Legal protection: Your assets are safe. The company is a separate legal entity, so your liability is limited.

- Easy to manage: With only one decision-maker, there are fewer compliance and coordination issues than in multi-owner companies.

- Full control: You have complete authority over business decisions since you’re the sole shareholder and director.

- Separate identity: An OPC has its own legal identity, which builds trust with clients, vendors, and banks.

Limitations of OPC

While One Person Companies offer several benefits, they also come with certain restrictions:

- Cannot raise funds from investors: Since there’s only one shareholder, bringing in equity investors or venture capital is impossible under the OPC structure.

- Only one shareholder allowed: You cannot add partners or co-founders as shareholders. The structure is strictly for a single individual.

- Cannot convert back to OPC once changed: If you convert your OPC into a Private Limited Company or any other type, you cannot revert it back to an OPC later.

Common Mistakes to Avoid

Even though registering an OPC is simple, many solo founders make small mistakes that can lead to big problems later. Here are some to watch out for:

- Choosing the wrong nominee: Your nominee will take over the company if something happens to you. Choosing someone unreliable or uninterested can cause issues in the future. Make sure your nominee understands their role and responsibilities.

- Missing filing deadlines: OPCs must file annual returns and financial statements on time. Delays can lead to heavy penalties, legal notices, or even company strike-off. Always stay aware of due dates and file timely.

- Using a personal account for business: Mixing personal and business transactions makes accounting confusing and non-compliant. Open a current account in your company’s name and use it exclusively for all business operations.

- No backup for digital signature (DSC): A DSC is needed to file the necessary documents. It can delay filings if lost, expired, or inaccessible. Keep a backup or renew it well in advance to avoid last-minute hassles.

Quick Tips for OPC Owners

- Keep records of income & expenses

- Always renew DSC on time

- Keep business and personal funds separate

- Use accounting software or hire a CA

NRIs Can Register an OPC in India

Yes, non-resident Indians (NRIs) can register for a one-person company in India!

Thanks to the Companies (Incorporation) Second Amendment Rules, 2021, NRIs who are Indian citizens and have stayed in India for at least 120 days during the last financial year are eligible to incorporate an OPC. This change opens up new possibilities for global Indians to establish their business presence in India through a simple and legally secure structure.

Conclusion: Is OPC Right for You?

If you are a solo founder, want low risk, and want a legal setup, then a One Person Company is a smart choice.

It’s easy to understand how to open a firm with this route. Starting your own company doesn’t have to be overwhelming. Setting up a One Person Company with a clear roadmap and proper compliance is straightforward and hassle-free.

Still have questions about the OPC registration process? The experienced team at FinGuru India is here to walk you through every step, from paperwork to post-registration support.

How FinGuru India Can Help

At FinGuru India, we make your OPC journey simple, quick, and stress-free. Here’s how we can support you:

- Free consultation to check your eligibility and clear your doubts

- End-to-end assistance with OPC registration under MCA

- Digital signature and DIN generation support

- Name approval and documentation handling

- Drafting of MOA & AOA by experts

- Timely filings and annual compliance reminders

- Dedicated compliance officer to manage your company’s legal status

We’ve helped hundreds of solo entrepreneurs like you confidently take their first step in business. Let FinGuru be your legal and financial partner, so you can focus on growing your dream. FinGuru India today or visit the rest.

Contact today or visit FinGuru India to schedule your free consultation and take the first step toward your One Person Company registration.

If you are a solo founder, want low risk, and want a legal setup, then a One Person Company is a smart choice.

It’s easy to understand how to open a firm with this route. Just follow the steps, keep your compliance in check, and grow your business with peace of mind.

Still confused about the one person company registration process? Let us help you get started.

📞 Book a Consultation with Our Expert!

📞 Call Us: +91-9999127022

🌐 Visit: www.FinguruIndia.com