Most people deal with taxes without ever understanding how they actually work. You see deductions in your salary, pay GST at a store, or notice customs duty on an imported product, but the bigger picture stays fuzzy. That’s why so many people ask what is direct and indirect taxes, how the two systems differ, and why India needs both.

Here’s the thing. When you know what direct tax and indirect tax mean, handling your money becomes much easier. You can plan your income, understand your expenses, see why things cost what they do, read your salary slip, and make better investment choices. India uses both direct tax and indirect tax, and each works in its own way with its own pros and cons.

Let’s break it all down in a detailed, practical way.

What is Direct Tax?

If you’re trying to understand what is direct tax, here’s the simple version: it’s a tax paid directly by the person who earns the money. The burden can’t be shifted. When your salary comes in, the government collects a slice as income tax. When a company earns profits, it pays corporate tax.

This is the first half of the definition of direct tax and indirect tax. Direct taxes focus on your ability to pay. You earn more, you pay more. They are personal, income-based, and tied to your financial capacity.

To ground this with recent figures: in the financial year 2024-25, gross direct tax collections in India were about ₹25.87 lakh crore (including corporate taxes, personal taxes, securities transaction tax, etc.).

For the period April-November 2025 (FY26 so far), net direct tax collections rose to about ₹12.92 lakh crore, representing a growth of 7% year-on-year. Business Standard+2mint+2

These numbers help you see why people often start with direct taxes when comparing direct and indirect tax.

Ready to Register Your Pvt Ltd Company Online?

Register your Pvt Ltd company online with ease. Learn the steps, documents, costs, and benefits so you can launch your business quickly and confidently.

register a Private Limited companyTypes of Direct Taxes in India

To understand direct tax and indirect tax, let’s walk through the main direct taxes you’ll encounter.

Income Tax

This is the most common direct tax. Salaried individuals, freelancers, professionals, and businesses pay tax based on their yearly income. Slabs typically range across 5%, 10%, 15%, 20%, and 30%. Recent data: In FY 2024-25, personal income tax collections were about ₹12.90 lakh crore.

Corporate Tax

Companies pay this tax on their profits. Most domestic companies fall in the ~22% category; new manufacturing firms might opt for ~15%. Recent data: For FY 2024-25, corporate tax collections stood at about ₹12.40 lakh crore.

Capital Gains Tax

If you sell a house, gold, mutual funds, or shares at a profit, you may pay capital gains tax. Rates vary across asset types and whether gains are short-term or long-term.

Securities Transaction Tax

This is a tax applied to certain market transactions – for example buying/selling of shares. It adds to direct tax burdens.

Together, these categories form a big part of the definition of direct tax and indirect tax — direct taxes target income, profits, or gains.

Advantages of Direct Taxes

Direct taxes offer several strengths that keep them at the core of the tax system.

Fair and Progressive

They follow the ability-to-pay principle. Higher income means higher contributions. That’s why any discussion on what is direct tax and indirect tax starts with the fairness of direct taxes.

Helps Reduce Wealth Gap

Because rates rise with income, direct tax plays a role in redistributing resources and reducing inequality.

Stable Revenue Source

Direct taxes provide predictable income that government budgets can rely on (despite fluctuations). For instance, direct tax collections have shown steady growth over years: one source notes a 274% growth in gross direct taxes over ten years.

With these advantages in mind, you can see why the mix of direct tax and indirect tax makes sense.

Disadvantages of Direct Taxes

Direct taxes also come with a few drawbacks:

Heavy Compliance

People need to maintain documents, proofs, bills, and file returns every year. Errors lead to penalties or audits.

Evasion Risks

Since reporting depends on individuals and businesses, under-reporting can occur. A recent study found that a huge amount of tax is still unpaid. By 2023–24, about ₹14 lakh crore in corporate tax and ₹14.6 lakh crore in income tax had not yet been collected. PRS Legislative Research

Can Affect Motivation

High direct tax rates might discourage higher earnings or risk-taking.

These gaps are the reason countries use indirect tax along with direct tax. Together, they complete the full system of how taxes work.

Common Direct Tax Rates in India

Exact numbers shift each year, but here’s a broad look to help you handle the concept of direct tax and indirect tax.

- Individual income tax slabs: generally in the 5-30% range (depending on choice of regime, income, etc.)

- Corporate tax: around 22% for standard domestic firms; around 15% for new manufacturing units

- Long-term capital gains on equity: ~10% beyond a threshold

- Long-term capital gains on property: ~20% with indexation

These give you a sense of how direct taxes work, aligning with the broader definition of direct tax and indirect tax structure.

What is Indirect Tax?

Now let’s move to the second half of what is direct tax and indirect tax.

An indirect tax is collected when you buy goods or services. It’s built into the price. The seller collects it, but the consumer pays it. You don’t see it in your salary; you see it when you pay the bill.

Indirect taxes have grown significantly. For example, in 2024–25, the government collected about ₹22.08 lakh crore through GST, which was around 9.4% higher than the previous year. Press Information Bureau+2Meetanshi – Magento & Shopify Agency+2

This is the other half of the definition of direct tax and indirect tax — indirect taxes focus on consumption, not earning.

Types of Indirect Taxes in India

Here’s how indirect tax breaks down in India:

GST

India’s biggest indirect tax. It replaced many earlier cascading taxes. It uses multiple slabs like 0%, 5%, 12%, 18%, and 28%. On certain goods, it may even be higher with cess.

Customs Duty

Imported goods attract duties. This is an indirect tax because the cost is passed to the importer/consumer via higher price.

Excise Duties on Select Goods

Products like fuel, alcohol, and tobacco often carry extra charges – these are also forms of indirect tax.

These categories define how direct and indirect tax operate in totally different ways: one on income, one on spending.

Advantages of Indirect Taxes

Understanding what is direct tax and indirect tax teaches us that indirect taxes play a critical role.

Easy Collection

Since the tax is charged during purchase, indirect tax flows automatically. For example, GST collection in October 2025 was about ₹1.96 lakh crore gross. The Economic Times+1

Broad Coverage

Even people not paying income tax (direct tax) still contribute via indirect tax when they buy goods and services.

Encourages Tax Compliance

GST reforms have made it easier to track and report taxes, which helps more businesses become part of the formal economy.

These benefits help balance the limits of direct taxes and strengthen the overall tax system.

Disadvantages of Indirect Taxes

Indirect taxes come with their own limitations:

Regressive Impact

Everyone pays the same rate regardless of income. Lower-income households feel this more, making indirect tax less fair in some respects.

Increases Prices

Any hike or addition in indirect tax immediately shows up in the cost of goods or services.

Business Compliance Burden

Consumers pay indirect tax automatically, but businesses have to manage all the paperwork. They need to file returns, keep invoices, handle credit notes, and match records, which adds extra work behind the scenes.

This is why the interplay of direct tax and indirect tax is essential for a comprehensive system.

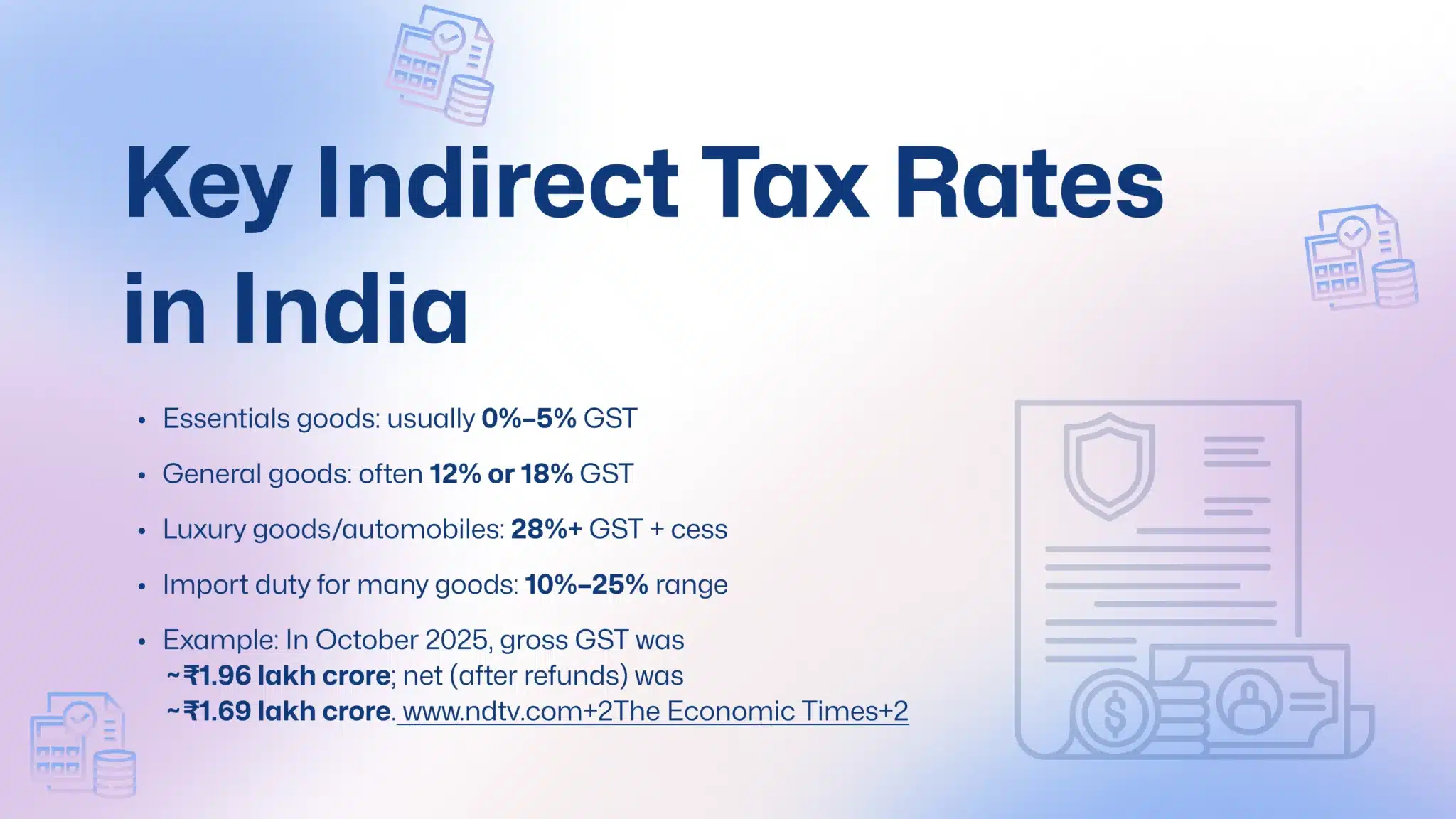

Key Indirect Tax Rates in India

To bring concreteness to the definition of direct tax and indirect tax, here are some recent indirect tax rates/collections:

These numbers help make the definition of direct tax and indirect tax real.

Direct vs Indirect Tax: A Practical Comparison

Here’s a side-by-side to help you when asking what is direct tax and indirect tax:

- Based on: Direct tax is on income; indirect tax is on spending.

- Burden: Direct tax burden cannot be shifted; indirect tax burden can be passed to the consumer.

- Fairness: Direct taxes are progressive; indirect taxes tend to be regressive.

- Visibility: Direct tax you see in your salary or returns; indirect tax you see when you pay retail bills.

This practical comparison simplifies how to think about direct tax and indirect tax.

Why These Taxes Matter to Individuals and Businesses

For Individuals

Direct tax affects how much you take home after deductions. If you understand what is direct tax, you can plan your savings, investments, and spending. Indirect tax affects how much your daily purchases cost – when you buy groceries, electronics, or services, you pay GST (an indirect tax).

For Businesses

Businesses have to manage both. They pay corporate tax (a direct tax) on profits and collect GST (an indirect tax) on sales. Both influence pricing, profit margins, and competitive strategy.

For Investors

When you sell shares or property and generate capital gains, direct tax applies. And when you buy goods or services, indirect tax shapes consumption and cost-structure. Because you’re part of the economy in both roles, the definition of direct tax and indirect tax matters to you.

Conclusion

By now, you should have a clearer idea of what direct tax is, how indirect tax works, and how India uses both. When you understand the meaning of direct tax and indirect tax, it becomes much easier to make better financial decisions.

Taxes aren’t just a deduction on your salary or an item on your receipt. They shape consumption, investment, inflation, equity, business strategy all of it. Knowing how direct tax and indirect tax operate helps you navigate them with far more clarity and control.

Looking for expert help?

If you need help with tax planning, business rules, or managing your money, FinGuru India can guide you and make everything easier to handle. Reach out to FinGuru India today and take control of your financial journey with confidence.