Starting a business in India is an exciting journey, but navigating the business registration process can be complex. From choosing the right business structure to complying with regulatory requirements, there are several crucial steps every entrepreneur must take. This guide provides a step-by-step approach to company incorporation in India, ensuring that startups and businesses comply with legal requirements while setting up for long-term success.

Why Register Your Business in India?

Registering your business provides multiple benefits, including:

- Legal Recognition – Protects your business under Indian law.

- Limited Liability Protection – Shields personal assets from business risks (for private limited companies and LLPs).

- Access to Funding – Essential for raising venture capital or bank loans.

- Tax Benefits – Eligible for deductions and government schemes.

- Brand Credibility – Enhances customer and investor trust.

Step-by-Step Guide to Business Registration in India

Step 1: Choose a Business Structure

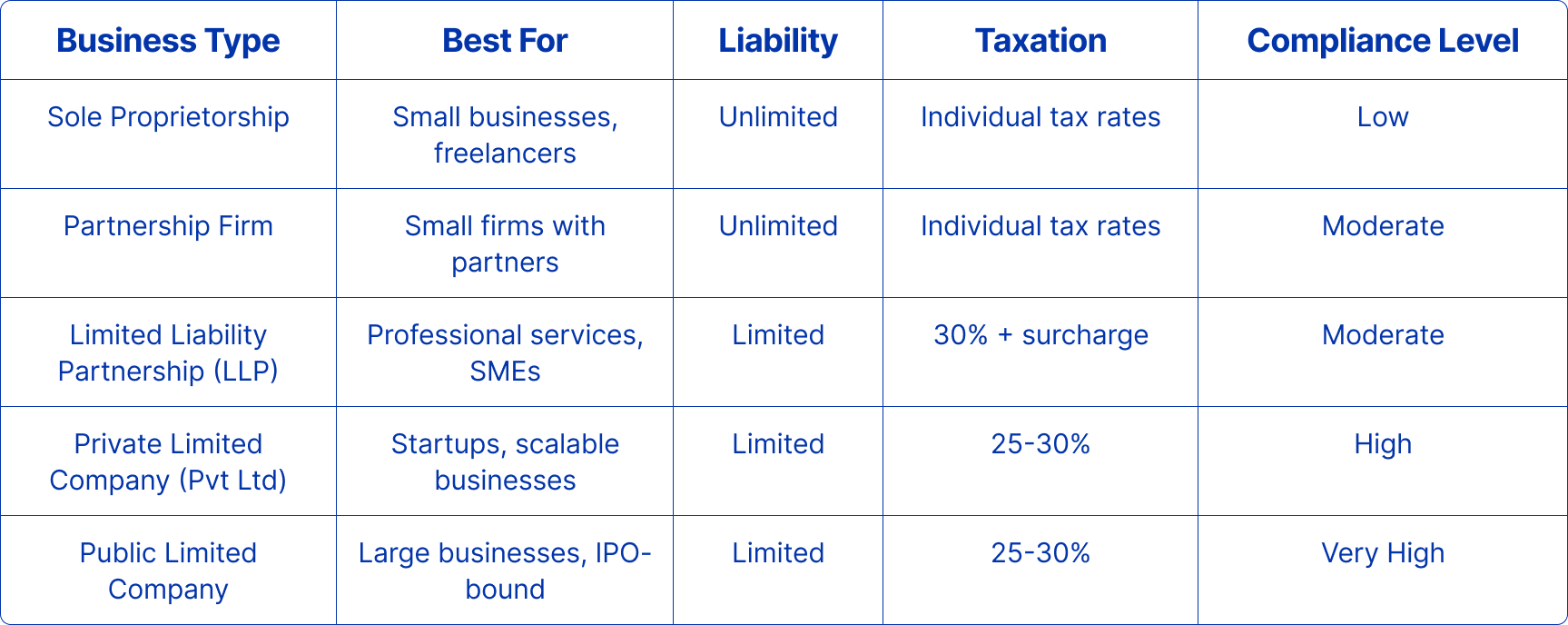

Selecting the right business entity is crucial as it determines legal compliance, taxation, and operational flexibility. Below are the common business structures in India:

Business structures in India[/caption] Refer to the Ministry of Corporate Affairs (MCA) guidelines for a detailed comparison of these structures.

Step 2: Obtain a Digital Signature Certificate (DSC)

- Required for online company incorporation.

- Obtained from Certifying Authorities like eMudhra, NSDL, or Sify Technologies.

- Documents needed: PAN card, Aadhaar card, and passport-size photo of directors.

Step 3: Apply for Director Identification Number (DIN)

- A Director Identification Number (DIN) is mandatory for company directors.

- Apply through the SPICe+ form on the Ministry of Corporate Affairs (MCA) portal.

Step 4: Reserve a Company Name (RUN Service)

- Choose a unique name that aligns with your business and complies with Companies Act, 2013.

- Conduct a name search on the MCA website to check availability.

- Apply for name approval through Reserve Unique Name (RUN) service.

Step 5: File for Incorporation (SPICe+ Form)

- Submit SPICe+ form along with MOA (Memorandum of Association) and AOA (Articles of Association).

- This step includes GST registration, EPFO, ESIC, and Professional Tax registration (if applicable).

- Pay the prescribed registration fee based on the company’s authorized capital.

Step 6: Obtain PAN, TAN & GST Registration

- Permanent Account Number (PAN) and Tax Deduction and Collection Account Number (TAN) are issued by the Income Tax Department.

- GST Registration is mandatory if annual turnover exceeds ₹40 lakh (₹20 lakh for services).

Step 7: Open a Business Bank Account

- Submit the Certificate of Incorporation, PAN, and address proof to open a current account.

- Essential for receiving payments and managing business transactions.

Startup Compliance & Legal Requirements in India

After incorporation, businesses must comply with several regulatory requirements, including:

1. Annual Compliance

- Filing Income Tax Returns (ITR).

- Submitting Annual Financial Statements to MCA.

- Maintaining proper Books of Accounts.

2. GST Compliance

- Filing Monthly/Quarterly GST Returns (GSTR-1, GSTR-3B, GSTR-9).

- Keeping invoices in compliance with GST laws.

3. Employee-Related Compliance

- Registering under EPFO & ESIC for employee benefits.

- Adhering to Minimum Wages Act & Payment of Wages Act.

4. Licensing & Sector-Specific Registrations

- Shops & Establishment License for businesses with physical offices.

- FSSAI License for food businesses.

- RBI License for NBFCs and fintech startups.

Challenges in Business Registration & Solutions

Despite the streamlined process, entrepreneurs face several challenges:

The Impact of Business Registration on Growth

Registering your business legally unlocks multiple opportunities:

- Easier access to funding from banks, VCs, and government schemes like Startup India.

- Better tax planning and eligibility for subsidies.

- Enhanced credibility among customers, investors, and stakeholders.

Conclusion

Registering your business in India is the first step toward building a successful and legally compliant enterprise. By following the company formation process, ensuring startup compliance, and adhering to legal requirements, entrepreneurs can set a strong foundation for sustainable growth. If you need expert guidance on business registration, FinGuruIndia is here to help. Visit our website or connect with us for professional assistance in setting up your company efficiently.